kansas inheritance tax rules

It is possible to avoid going through probate in Kansas if you. If the deceased persons assets are not set up with an estate plan for.

Estate Taxes Are A Threat To Family Farms

There is no federal.

. The estate must be valued at no more than 25000 and only contains personal property. Many cities and counties impose their. The state sales tax rate is 65.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Kansas Probate and Estate Tax Laws. These are the different tax laws by state.

All Major Categories Covered. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. The new Kansas estate tax act found in SB365 Chapter 199 of the 2006 Session Laws provides for a.

Talk To A Local Expert. In this detailed guide of the inheritance laws in. Opry Mills Breakfast Restaurants.

In this detailed guide of the inheritance laws in. Kansas real estate cannot be transferred with clear title after the death of an owner or co. As of 2013 estates in Kansas are not subject to a state-level estate tax.

There is no federal inheritance tax but there is a federal estate tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. There are 38 states in the country that do not have an estate tax in place.

State inheritance tax rates range from 1 up. As a general rule only estates larger than 534 million have to pay federal estate taxes. The personal estate tax exemption.

Small estates can bypass. Kansas Inheritance Tax Rules. Connect With Experienced Local Inheritance Estate Lawyers.

Select Popular Legal Forms Packages of Any Category. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Ad 100 Free Consultation.

The state sales tax rate is 65. In 2019 that is. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

How Do You Avoid Probate in Kansas. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. Federal Taxes The federal government does not charge an inheritance tax but does maintain an estate tax.

Related Resources The probate process. Additionally the spouse and minor children are entitled to a family allowance of 35000 and a homestead exemption of 1 acre of a city residence or 160 acres outside of a city regardless. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. The 2006 Kansas Legislature made substantial changes to the Kansas estate tax.

The following table outlines probate and estate tax laws in Kansas. Regular probate proceedings include uncontested and contested estates.

Kansas State Taxes 2021 Income And Sales Tax Rates Bankrate

Kansas Gift Tax How 99 Can Legally Avoid Top Strategies

State Estate And Inheritance Taxes Itep

Gift Annuity Regulations By State Crescendo Interactive

Kansas Estate Planning Probate Attorneys Other Professionals Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

An Overview Of Kansas Divorce Laws 2022 Guide Survive Divorce

How Lamar Hunt Set The Standard For Nfl Succession Plans Sportico Com

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Kansas And Missouri Estate Planning Inheritance Tax

What Are The Inheritance Rules In The Usa Us Property Guides

Kansas Estate Planning Attorney Says To Steer Clear Of These Estate Planning Mishaps

Complete Guide To Probate In Kansas

Transfer On Death Tax Implications Findlaw

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Does Kansas Charge An Inheritance Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

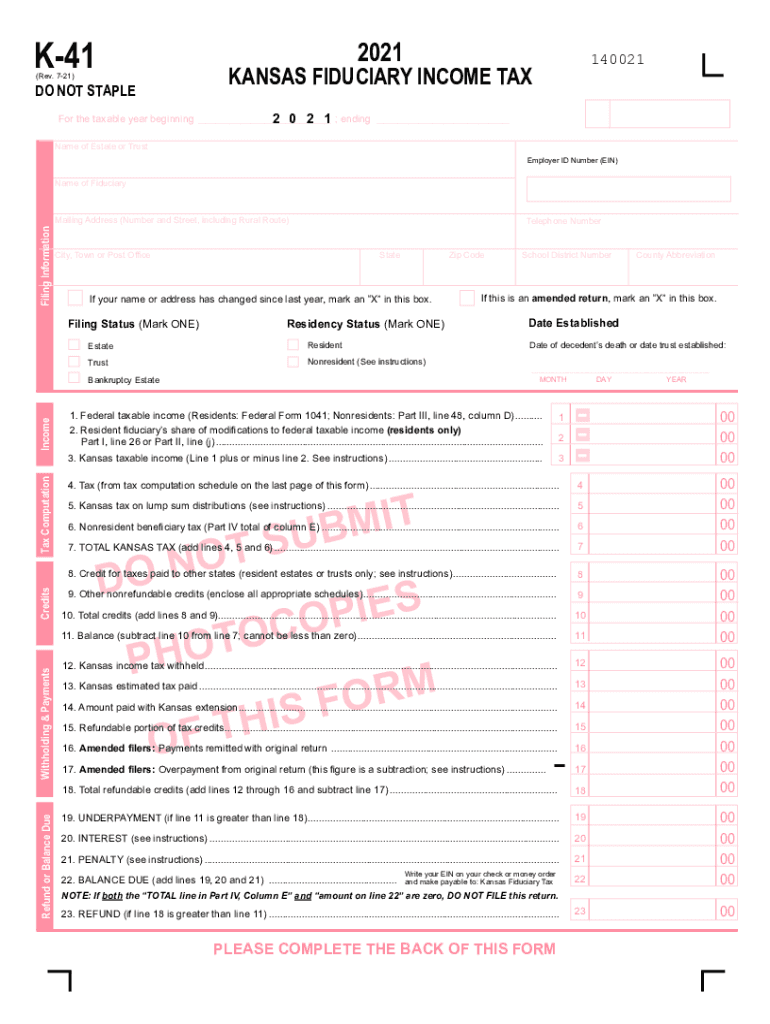

Ks Dor K 41 2021 2022 Fill And Sign Printable Template Online Us Legal Forms